How We Set a Christmas Budget That Actually Works

A Christmas budget on paper is one thing. A Christmas budget that holds up once the invitations, sales, and “it’s only $15” moments start flying is another. What finally worked for us was getting really clear and specific long before December instead of trying to rein things in when we were already in the thick of it.

We stopped pretending we could “wing it” and still feel good in January. Now the budget isn’t a wish—it’s a plan we build around real numbers, real people, and the way our family actually spends.

Start with what you spent, not what you wish you spent

We look at last year’s bank statements and write down what actually went out: gifts, food, travel, extras. It’s humbling, but it’s real. Seeing that total in black and white is usually a wake-up call, especially when you include the quick store runs and last-minute online orders you forgot about.

Then we decide what needs to change—cutting back in certain areas, or planning better so it doesn’t feel like a shock. Sometimes that means shrinking the total. Sometimes it just means being honest that Christmas really does cost X in our house, and working toward that number through the year instead of pretending it will magically be cheaper next time.

Break it into categories

Instead of one vague number, we set:

- Gift total

- Food/hosting total

- Travel total

- Extra: decor, activities, teacher gifts

Each category gets a chunk of the overall budget. If one creeps up, we know where we have to pull back. It also keeps us from blowing half the budget on groceries and snacks because we “forgot” how many gatherings we said yes to.

Having categories keeps decisions grounded. When the kids ask to add one more outing, I’m not deciding in a vacuum—I can look at the “activities” number and see if there’s room or if something else has to give.

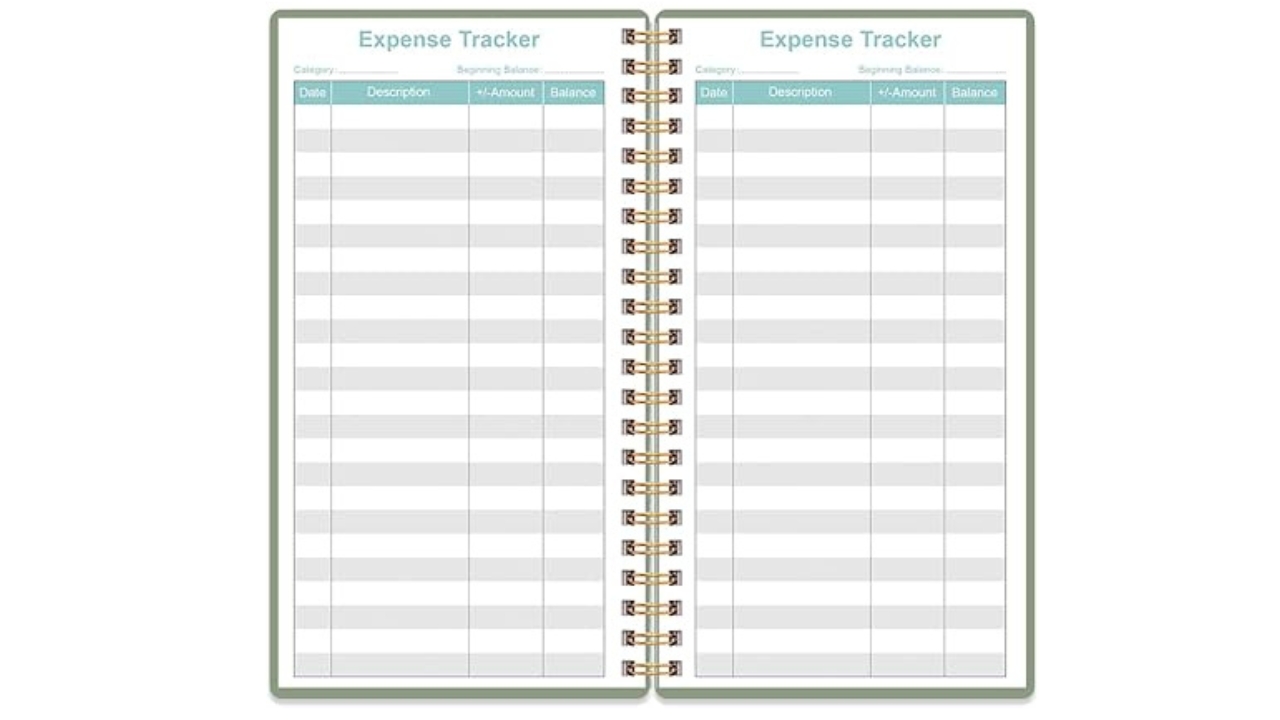

Use a separate account or tracking sheet

We either move the Christmas money into its own account or track every Christmas purchase in a simple note or spreadsheet. Seeing the total in one place keeps us honest. When it’s mixed into everyday spending, it’s easy to lose track and assume we’re doing “fine.”

“Out of sight, out of mind” is exactly how budgets fall apart. I’d rather see the number dropping as we shop and know we’re still inside the fence than bury my head and feel sick when the bills show up. If you don’t want a separate account, even a paper envelope with cash and a running total on the front is better than nothing.

Agree on rules before shopping

We talk through basics:

- Who we’re buying for

- Price ranges

- How many gifts per kid

- What counts as a “gift” versus stocking or extra

Those decisions are made once, calmly, not in the middle of a store when we’re tired. It cuts down on a lot of, “Well, I thought we were doing this,” arguments and that panicked feeling you get when carts are already full.

We also decide ahead of time what’s off the table: no new decor themes this year, no extra “just because” outings, whatever fits the season we’re in. Having those guardrails before the emotions hit makes it easier to stick with them.

Adjust as we go instead of ignoring reality

If travel ends up costing more, we scale back somewhere else. If we already hit the gift budget, we stop. The plan is flexible, but we don’t pretend a limit doesn’t exist. It’s better to admit mid-December, “We’re tapped out in this category,” than to swipe a card and hope it works itself out later.

We check in a couple of times during the season, even if it’s just a ten-minute conversation after the kids are in bed. “Here’s what we’ve spent, here’s who’s left, here’s where it feels tight.” That tiny pause keeps the budget alive instead of turning it into a pretty idea we forgot about.

Like Fix It Homestead’s content? Be sure to follow us.

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.