The inspection note buyers regret brushing off

In a hot market, it is tempting to treat the inspection report as one more hurdle to clear on your way to closing. Yet the note you skim past or dismiss as “minor” is often the one that turns into the repair you cannot afford, the safety risk you did not anticipate, or the daily irritation that slowly poisons your relationship with the home. If you understand how those overlooked lines translate into real‑world regret, you are far less likely to join the chorus of buyers who wish they had paid closer attention.

What you are really buying is not just a structure, but a way of living inside it, and the inspection is the closest thing you get to a test drive. When you read it as a negotiation prop instead of a roadmap to risk, you miss the chance to walk away, renegotiate, or plan realistically for what comes next.

The pressure that makes you ignore the fine print

By the time you receive an inspection report, you are usually emotionally committed, financially stretched, and exhausted by showings and offers. That is exactly when you are most likely to downplay serious notes as “normal for the age” or “something we can handle later,” especially if you have already waived other protections to win the deal. During the Covid buying frenzy, buyers routinely skipped contingencies altogether, and many would “inspect for knowledge only,” which meant they saw the report but had already given up their ability to cancel based on what it revealed, a pattern described in detail in guidance on During the Covid bidding.

That culture of rushing has consequences. According to a study cited by Apr and According, by June of 2020 roughly 20 percent of winning bidders were already waiving their home inspection outright, up sharply from earlier in the year, which meant a growing share of buyers never even saw the red flags that might have changed their minds, as detailed in research from Redfin. When you combine that kind of competitive pressure with a dense, technical report, it is easy to see how a single understated line about moisture, wiring, or settlement can be brushed off in the rush to keep the deal alive.

The structural sentence that should stop you cold

Among all the inspection notes you might be tempted to minimize, anything hinting at foundation movement or structural instability is the one you cannot afford to ignore. A casual reference to “minor cracking” or “sloping floors” can be the surface symptom of a problem that affects every system in the house, from doors that will not close to walls that separate from ceilings. Specialists describe this as The Foundation Problem That Haunts Homebuyers Everywhere, and in one widely cited table of defects, foundation issues sit at the top of the Red Flag Category list with the highest Severity Level, underscoring that they must be addressed before the next season rather than deferred indefinitely, as outlined in Foundation Problem That.

When inspectors or engineers talk about Structural Issues, they are not just warning about cosmetic cracks. They are flagging conditions that can literally undermine the building, from failing footings to compromised load‑bearing walls. One technical breakdown of Major Home Inspection Issues lists Structural Issues first, ahead of Roof, Plumbing, Electrical, and Heating and Cooling System concerns, because structural instability can magnify every other defect and make repairs exponentially more expensive, as explained in a guide to Major Home Inspection. If your report hints at movement, settlement, or significant cracking, that is not a line to negotiate around, it is a reason to pause the entire purchase until you have a clear, expert‑backed cost to fix it.

The safety note that is really a liability warning

Some of the most important sentences in an inspection report are the ones that sound dry but actually describe immediate danger. References to “double‑tapped breakers,” “improper venting,” or “elevated moisture” can translate into fire risk, carbon monoxide exposure, or mold that affects your health. Detailed checklists of Common Reasons Buyers Back Out After Home Inspection Safety Concerns highlight Issues like faulty wiring, gas leaks, and mold as problems that can make a property no longer worth the price, because they combine high repair costs with serious health stakes, as laid out in an analysis of Common Reasons Buyers.

When you see language about “recommend further evaluation” around electrical, gas appliances, or air quality, you are not just looking at a future maintenance item. You are being told that the home may contain poor electrical wiring, carbon monoxide risks, mold, or radon that could harm you or your family, hazards that many buyers only discover after a disastrous incident because they did not fully Assess for danger when they had the chance, as described in a safety‑focused guide that urges you to Assess for hidden threats. Treat those notes as non‑negotiable: either the seller fixes them with permits and documentation, or you budget for immediate remediation and decide whether the home still makes sense at the agreed price.

The “lived‑in” problems inspections barely touch

Even a thorough inspector has limits, and some of the frustrations that drive the worst buyer’s remorse barely show up in the report at all. Short video explainers recorded in Jan point out that inspections do not catch the problems buyers regret most, because they focus on checking boxes rather than testing how a home actually lives, from noise and flow to storage and privacy, a gap highlighted in one clip that notes inspectors rarely evaluate how sound carries or how cramped a kitchen feels, as discussed in a Jan commentary on inspections.

Another Jan breakdown of buyer regrets stresses that inspectors tend to tell you what is broken, not what will slowly drive you crazy, such as traffic noise in a bedroom, awkward room layouts, or a lack of closets, all of which can matter more to your daily happiness than a worn water heater, as emphasized in a follow‑up short on noise. That is why you need to pair the technical report with your own due diligence: visit at different times of day, stand quietly in each room, imagine where your furniture will go, and think about how you will actually use the space. The inspection can tell you whether the house is safe and functional, but only you can decide whether it fits the life you want to live.

The quiet line that signals years of hidden damage

Some of the most expensive problems are the ones that have been quietly eating away at the house for years before you ever scheduled an inspection. Notes about “elevated moisture,” “evidence of past leaks,” or “possible termite activity” can indicate long‑running issues behind walls and under floors. Technical reports on hidden defects explain that Structural instability from concealed rot or pest damage does not just erode the physical stability of your property, it also chips away at your financial security, because you may face sudden, large‑scale repairs you never budgeted for, a risk spelled out in detail in an overview of Undeniably serious hidden issues.

Real‑world stories show how easily buyers can be nudged into ignoring these clues. In one widely shared account from Sep, a homeowner describes how their inspector brushed off warped siding, 30+ year old furnaces, and obvious mice droppings as minor, only for those “small” issues to turn into major expenses and daily stress a few years later, a cautionary tale captured in a post titled “3.5 years into owning this house and I regret my purchase,” which notes that he brushed off any issue as minor and the buyer now regrets not pushing harder for credits from the sellers, as recounted in a Sep discussion. When your report hints at long‑term moisture, pests, or aging mechanicals, treat that as a signal to bring in specialists and get real numbers, not as a footnote you can ignore.

The emotional spiral after you move in

Even when the inspection is technically accurate, the way you feel about the house in the first months can make every small flaw seem like proof you made a mistake. Buyers who were sure they had found “the one” often discover new problems only after the boxes are unpacked, from lingering pet odors to uneven floors, and that gap between expectation and reality can trigger intense regret. One homeowner posting in Oct describes how they did not notice a bad dog odor until they moved in, then ended up ripping out the carpet, using Killz primer, and installing vinyl flooring to make the space livable, a reminder that some issues only reveal themselves with time and use, as detailed in a thread that begins with “Ripped out the carpet” and unpacks how much such fixes can cost, documented in an Oct conversation.

Another homeowner writing in Sep describes “struggling with major buyer’s remorse,” worrying not only about current flaws but also about what they will be able to afford once they leave, and whether they passed on homes that would have fit their needs better, a fear that shows how quickly financial anxiety can attach itself to every crack and creak, as shared in a candid Sep post. To keep that spiral in check, you need to separate genuine inspection misses from the normal adjustment period of living in a new space, and remember that some frustrations can be solved with targeted projects rather than a total do‑over.

The decision point: renegotiate, repair, or walk away

Once you understand what the inspection is really telling you, the next step is deciding how to respond, and that is where many buyers feel paralyzed. Some agents push hard to keep deals alive, but you are the one who will live with the consequences. In one Mar discussion, a buyer who backed out after seeing the inspection report was told bluntly that their approach to risk was not aligned with their realtor and that they should work with a new agent, a reminder that Your comfort level matters more than anyone else’s commission, as argued in a thread that opens with “Your approach to things is not aligned with your realtor,” which also notes that Some types of loan such as FHA may require certain repairs like electrical and front steps to be addressed before closing, as explained in a detailed Mar exchange.

Other buyers discover that sellers will accept a lower price or repair credits rather than start over with a new listing. One account from May describes how They rejected an offer at 915k because it had contingencies, even though There were buyers willing to pay that price if they could keep inspection protections, illustrating how much leverage you can gain or lose depending on what you are willing to waive, as debated in a May thread. Your job is to translate the inspection into a clear decision tree: if the cost and risk of repairs fit your budget and tolerance, you renegotiate or plan the work; if they do not, you use your contingency to walk away before the note you ignored becomes a crisis you own.

The clock that quietly locks you in

Even if you read every line of the report, timing can still trip you up. Most contracts give you a defined inspection contingency period, and if you miss that window, you may lose your right to ask for repairs or cancel. Standard guidance explains that If the buyer does not respond to an inspection or submit an addendum requesting repairs within the contingency period, the contract usually moves forward as written, and in some cases the buyer is treated as having accepted the property as‑is simply by failing to respond at all, a procedural detail spelled out in advice on what happens If the buyer stays silent.

How to read the next report like a pro

Like Fix It Homestead’s content? Be sure to follow us.

Here’s more from us:

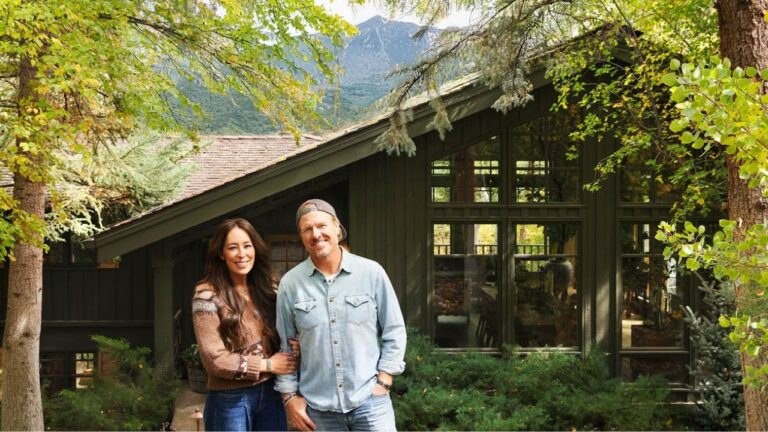

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.