The receipts insurers ask for that most homeowners throw away

When a pipe bursts or a wildfire races through your neighborhood, the last thing you want is a fight over paperwork. Yet the difference between a smooth homeowners claim and a months‑long dispute often comes down to the receipts you kept, and the ones you tossed. Insurers routinely ask for proof that you owned what you say you owned, paid what you say you paid, and spent what you say you spent after the loss.

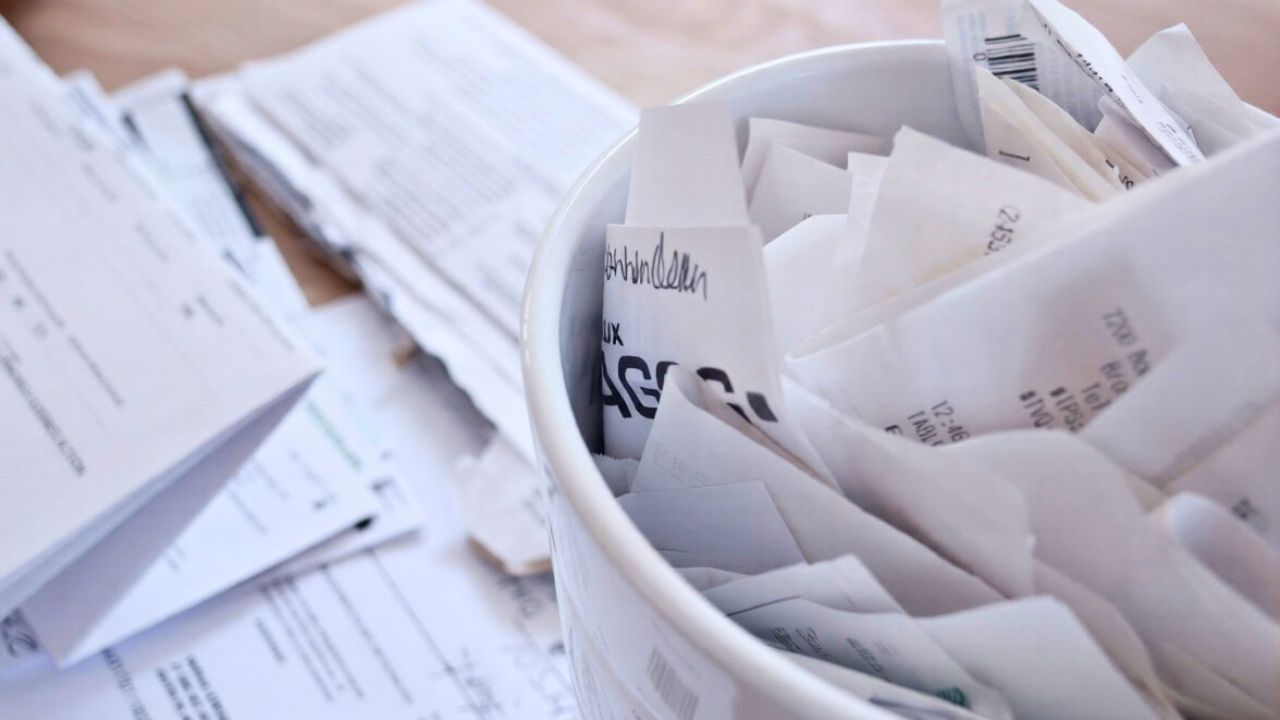

That proof is rarely glamorous: grocery slips, hotel folios, contractor invoices, even the receipt for the gaming console you bought three years ago. You might throw them away without a second thought, but your insurer may treat them as the “receipts or it did not happen” backbone of your claim. Understanding which records matter most, and how to keep them without drowning in clutter, is one of the most practical forms of financial self‑defense you can practice as a homeowner.

Why insurers care so much about documentation

From your insurer’s perspective, every claim is a math problem that starts with proof. Adjusters are trained to verify what was damaged, what it cost, and what it will take to repair or replace it, and they lean heavily on receipts and other records to do that. Legal guidance on Documentation Supports Your notes that documentation is fundamental to proving the extent of your loss and the value of your property, and it also protects you against accusations that you are exaggerating or fabricating a claim. Without that paper trail, you are asking the insurer to take your word for it, which is not how their internal controls are designed to work.

That skepticism is not always subtle. One consumer‑facing law firm points out that Insurance companies want to make it hard on you so they do not have to pay out as much on your claim, and they use documentation demands as one of those levers. Another consumer guide on disaster recovery explains that Your homeowners policy requires you to complete a claim report listing damaged property, including items like holiday decorations or outdoor furniture, and that list is far more persuasive when it is backed by receipts and photos. The more organized your records, the less room there is for an adjuster to dispute your numbers.

The everyday receipts you regret tossing after a loss

Most homeowners are disciplined about keeping closing documents and maybe a few big‑ticket invoices, but the receipts that cause the most trouble are often the everyday ones. A detailed guide on claim preparation notes that Residential Property claims often hinge on proof of what you spent on temporary shelter, meals, and emergency supplies when your home was not safe to occupy. Those are exactly the receipts you are likely to crumple into a pocket or leave in a hotel room trash can, even though they can be reimbursable under your policy’s “loss of use” coverage.

Personal property receipts are another blind spot. One insurer’s consumer blog stresses that you should Remember this general of thumb: if an item costs more than you can afford to lose or replace, keep the receipt. That includes furniture, appliances, and electronics that you might assume are “obviously” in your home. A separate legal FAQ notes bluntly that Many people toss out their receipts after purchasing those items, only to find themselves scrambling to prove ownership later.

Big‑ticket items: electronics, appliances and furniture

When insurers talk about documentation, they are especially focused on high‑value items that are easy to steal or misrepresent. Guidance on claim preparation singles out Valuable electronics like computers, televisions, and gaming systems, noting that these devices are expensive and that keeping the receipt will help prove both ownership and value. The same logic applies to high‑end refrigerators, washers, and dryers, where model numbers and purchase dates affect how your insurer calculates depreciation and replacement cost.

That is why some consumer guides on home inventories recommend logging serial numbers and attaching receipts for major purchases in a central file. One inventory checklist explains that What is a is essentially an itemized list of your possessions that helps you select the right amount of coverage and speeds up claims. Another inventory guide notes that Some insurance companies need receipts for items, while a photograph and serial number will be sufficient for others, but having both means your claim can be approved more quickly. For big‑ticket items, the receipt is not clutter, it is leverage.

Proof of repairs and upgrades you have already made

Another category of receipts that quietly shape your claim are the ones tied to repairs and improvements you completed long before the loss. If you upgraded your roof, replaced old wiring, or installed impact‑resistant windows, you want your insurer to recognize that your home was worth more and may cost more to restore. A detailed advisory on repair documentation stresses Importance of Keeping after a claim, and urges you to maintain receipts for all work you have done to your property.

That same guidance, expanded in a more detailed version, explains that you should Maintain Receipts for and retain invoices for any upgrades you have made to your property, because those documents help establish the pre‑loss condition of your home and justify higher repair estimates. If you cannot show that you replaced a standard shingle roof with a premium metal one, for example, your adjuster may default to pricing the cheaper material. In effect, every contractor invoice you save is a hedge against being pushed into a lower‑quality repair later.

Loss of use: the hotel and restaurant receipts that decide your check

When your home is uninhabitable, your policy’s “loss of use” or “additional living expense” coverage is supposed to keep you from paying twice for housing and basic living costs. In practice, that coverage is only as strong as your receipts. A state consumer brochure instructs you that if your property is not safe for occupancy, you should keep receipts for all expenses associated with your relocation, such as emergency shelter, temporary rentals, and extra transportation. Those slips of paper are how you prove that the hotel stay or rental car was a necessary additional expense, not just a lifestyle upgrade.

Public adjusters who specialize in these disputes go even further, urging you to build what they call Creating an Undeniable that leaves no room for doubt. Their homeowners insurance checklist advises you to log every hotel bill, restaurant tab, laundry charge, and extra commute cost, and to keep the original receipts organized by date. A separate consumer banking guide on claims echoes that advice, urging you to Document everything and noting that if your home is uninhabitable, almost every extra living expense will likely be reimbursable, but only if you can prove it.

Home inventories: the receipts that make your list believable

Insurers increasingly expect you to have at least a basic home inventory, and receipts are what turn that list from a wish‑list into evidence. One major carrier explains that What is a is an itemized list of all your possessions meant to help you select the right amount of coverage and speed up claims. Another guide on how to build that list notes that How do I a home inventory can be as simple as writing it down, taking photos, or using a smartphone app, but the most effective inventories attach receipts or at least purchase dates and prices to each entry.

Regulators echo that expectation. A state disaster recovery manual explains that What information you must give to the company representative includes a detailed list of damaged property, from major appliances down to holiday decorations or outdoor furniture. A separate inventory guide for warranties and policies notes that Some insurance companies need receipts for items, while others will accept photos and serial numbers, but in both cases, the more documentation you attach to your inventory, the faster your claim can be approved. If you build that file before disaster strikes, you are not trying to reconstruct your entire household from memory under stress.

When you do not have receipts: how to backfill proof

Even the most organized homeowner will not have a perfect file, and insurers know that. The problem is that missing receipts give them an opening to question your numbers or deny items altogether. A consumer law FAQ warns that Insurance companies want to make it hard on you so they do not have to pay out as much, but it also notes that there are other forms of proof that can help establish ownership, such as photos, credit card statements, or product registrations. That is your fallback plan when the original paper is gone.

The same FAQ acknowledges that Many people toss out receipts for furniture, appliances, and electronics, but encourages you to gather any photos showing the items in your home, warranty documents, or emails confirming online purchases. A separate consumer piece on luxury goods notes that Insurance companies ask for receipts if your claim is big enough, and that without them, you might get less, or even no, payout if something happens. That is a stark reminder that while alternative proof can help, it is rarely as strong as the original receipt.

How to keep receipts without drowning in paper

Knowing which receipts matter is only half the battle; the other half is building a system that you will actually use. One insurer’s blog on claim preparation suggests that you keep 6 receipts categories that make insurance claims easier, focusing on big purchases, home improvements, and key documents like appraisals. Another section of that same guidance emphasizes that you should Remember this rule of thumb about any item that costs more than you can afford to lose, and it encourages you to record the serial number of home items alongside the receipt.

Digital tools make that easier than it sounds. A home inventory guide explains that There are a to keep track of your inventory, including writing it down, taking photos, or using apps that let you upload images of receipts and link them to specific items. Another inventory explainer notes that What is a can be as simple as a spreadsheet stored in the cloud, where you attach scanned receipts and photos. If you snap a picture of every important receipt with your phone and drop it into a dedicated folder or app, you get the protection of documentation without the shoebox of fading thermal paper.

Turning receipts into a faster, fairer claim

All of this record‑keeping pays off when you are actually filing a claim. A step‑by‑step guide to the process advises you to Have your info ready when you contact your insurer, including a list of damaged items, their approximate value, and any receipts or photos you have. A separate consumer banking article on claims underscores that you should Take time now to understand your policy and document everything, because if your home is uninhabitable, almost every extra living expense will likely be reimbursable when you can show the receipt.

Regulators and legal experts frame this as a form of self‑protection. One legal analysis of Important Role of in Insurance Claims notes that thorough documentation not only supports your claim but also protects you against fraud accusations, because you can show exactly what you owned and what you spent. A state guide on Residential Property claims reiterates that if your property is not safe for occupancy, you should keep receipts for all relocation expenses, and that detailed records will help the company adjust your claim more quickly. When you treat receipts as part of your home’s safety net rather than disposable scraps, you give yourself a better shot at a full and timely payout when you need it most.

Like Fix It Homestead’s content? Be sure to follow us.

Here’s more from us:

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.