The repairs homeowners are skipping first when money gets tight

When household budgets tighten, homeowners are not just trimming vacations and restaurant meals. They are quietly pushing critical fixes and upgrades further down the to-do list, even as the long-term costs of delay keep climbing. The pattern is clear: cosmetic projects are the first to go, but increasingly, essential maintenance is getting kicked down the road too.

That shift matters for safety, insurance coverage, and long-term wealth. Skipped repairs can turn a manageable bill into a financial shock, and the data now shows how widespread the problem has become, from peeling paint and aging roofs to hidden hazards inside walls.

Cosmetic projects are the first to be sacrificed

When money gets tight, I see homeowners start by cutting what feels optional, and the first casualties are usually cosmetic upgrades. Fresh paint, new flooring, and other aesthetic tweaks are easy to frame as “nice to have,” especially when groceries and mortgage payments are competing for the same dollars. One survey found that 71% of respondents were Homeowners Postponing Renovations Due to Economic Concern, with Painting, flooring or other aesthetic work topping the list at 48%, a clear sign that visual upgrades are the first to be sacrificed.

That instinct lines up with broader spending patterns. As budgets tighten and remodeling costs rise, homeowners are recalibrating what counts as urgent, often reserving cash for emergencies and deferring anything that does not immediately affect habitability. Industry research into Homeowner Readiness to Spend on Home Improvement Projects points to tighter budgets and rising project costs as key reasons people are shelving nonessential work. In practice, that means living with dated kitchens, worn carpets, and half-finished basements far longer than planned, even in homes that otherwise look financially stable from the outside.

Necessary repairs are getting pushed off too

The more troubling shift is that essential fixes are now joining the list of delayed projects. A national survey found that 60% of homeowners are putting off necessary home maintenance or repairs, and more than 40% have at least one issue they already suspect will cost them thousands if it gets worse. Those Key findings include a warning that the projects they are delaying could average about $5,650, a painful bill for any household that thought it was saving money by waiting.

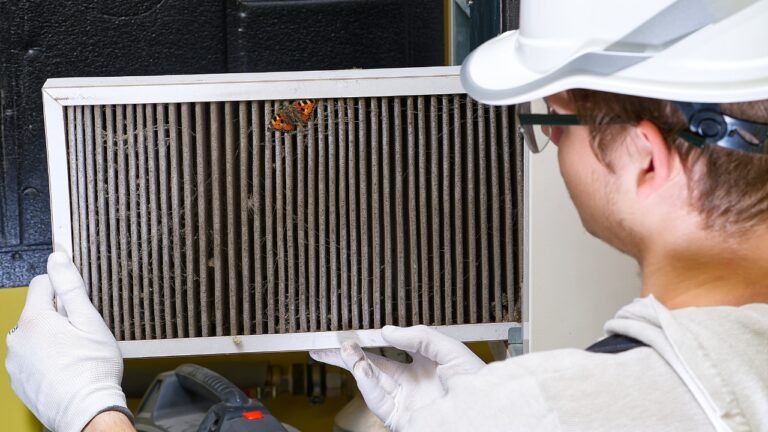

Other research echoes that strain. One analysis of financially stressed owners reported that many are delaying essential work because they cannot comfortably cover even a $1,000 project out of pocket, a trend flagged under Housing and Mortgage Trends by Jonathan Delozier. Another consumer-focused Study found that 71% of homeowners are already behind on maintenance and repairs, and many admit they are likely to keep postponing their inevitable home maintenance needs. The result is a growing backlog of leaky pipes, aging furnaces, and cracked foundations that will not fix themselves.

Roof, gutter and exterior neglect carry hidden risks

From the street, a house with a few missing shingles or sagging gutters can look like a minor cosmetic problem. In reality, roof and gutter neglect is one of the most expensive forms of procrastination. In California, for example, homeowners who shrugged off “small” issues like Roof and Gutter Neglect and Clogged downspouts later faced major water damage when an unexpected rainstorm hit, turning a simple cleaning into roof replacement and interior repairs.

Roofing contractors are now blunt about the stakes. One firm described Home Maintenance Procrastination as a Growing Crisis Among Homeowners, warning that a small leak ignored today can become a task costing $5,650 to complete once rot, mold, and structural damage set in. That pattern is playing out across the country as more owners delay exterior work until they see visible damage inside, at which point the repair is no longer optional and the price tag has multiplied.

Insurance and safety consequences of skipped upkeep

Delaying repairs is not just a budgeting strategy, it can also reshape a homeowner’s risk profile. Insurers are paying close attention to maintenance habits, and some owners are already feeling the consequences. Within the past year, 44 percent of homeowners said they have delayed performing routine maintenance tasks, and a significant share also admitted they are putting off necessary renovations and repairs. Those patterns, documented in a survey that begins with the phrase Within the, are already feeding into tougher underwriting and coverage decisions.

Safety concerns are rising in parallel. Reporting on how Financially stressed homeowners are delaying essential repairs highlights that many are actively deferring maintenance that affects electrical systems, structural integrity, and fire risk. When a furnace goes unserviced or a loose handrail is never fixed, the hazard is not theoretical. It can mean carbon monoxide leaks, falls, or electrical fires that might have been avoided with a relatively modest repair bill.

Why homeowners rationalize waiting

Even as the risks mount, the logic behind delay can feel compelling in the moment. Renovations and repairs are expensive and disruptive, and many owners tell themselves they will act when the economy feels more stable. One national poll found that 69% of respondents prioritize necessary upgrades and are willing to wait on everything else, a sentiment captured in a feature that asked What repairs homeowners are postponing until the economy improves. In practice, that often translates into a moving target where “later” keeps slipping further away.

Financial advisors are increasingly blunt that not every project deserves an immediate green light. One consumer survey quoted a warning that, “Given how expensive and time-consuming renovations are, it often does not make sense to rush into a project that is not really necessary,” a reminder, linked through Given, that discernment matters. The problem is that many homeowners apply that logic to clearly necessary work, convincing themselves that a slow leak or flickering outlet can wait, even when the evidence suggests otherwise.

The compounding cost of deferred maintenance

Across industries, the math on delay is remarkably consistent: waiting usually costs more. Asset managers describe how Deferring or avoiding maintenance may be an alluring step toward short-term financial savings, but it comes with dire long-term consequences, from higher repair bills to lost productivity. The same logic applies at home: a $300 service call skipped today can morph into a multi-thousand-dollar replacement when a system fails at the worst possible time.

Facilities experts who manage large commercial buildings frame this as a form of “technical debt,” where maintenance and upgrades deferred in favor of other priorities result in high future costs that could have been avoided. One analysis of how to tackle technical debt notes that this includes maintenance and upgrades deferred until a solution reaches end-of-life, a pattern that mirrors how many homeowners treat aging HVAC units and water heaters. The warning, captured in guidance on how to tackle technical debt, is simple: the longer you wait, the more you pay, and the less control you have over when that bill comes due.

When “invisible” problems become financial shocks

Some of the most dangerous deferred repairs are the ones homeowners cannot see. Hidden issues inside walls, attics, and crawl spaces are easy to ignore until they erupt into a crisis. One stark example involves defective materials like Chinese drywall, where experts warn that Every month You delay, the costs will increase, potentially forcing you to replace entire HVAC systems and rewire your home. Those cascading failures can turn a localized problem into a full-scale renovation that might have been avoided if you acted sooner.

Property managers who oversee large portfolios see the same pattern in everything from plumbing to structural repairs. One guide on the Delaying of necessary repairs notes that postponing work may seem like a way to save money in the short term, but it often leads to bigger problems that affect your bottom line. For homeowners, that bottom line can mean drained emergency funds, new credit card debt, or even forced sales when a property becomes too expensive to fix.

Rising costs are reshaping what gets fixed first

Inflation in the trades is another reason owners are reordering their repair lists. The cost of materials and labor has climbed sharply, and some categories of home maintenance have seen especially steep year-over-year increases. A breakdown of Which home maintenance costs have increased the most shows that certain Project types now carry far higher Year over Year jumps than others, pushing homeowners to triage based on what they can afford rather than what is most strategic.

That squeeze is changing how people think about their homes as investments. Research into Home Improvement Projects and Homeowner Readiness suggests that tighter budgets and rising remodeling costs will continue to have an impact in 2026, meaning today’s deferrals could stretch on for years. In that environment, the order of operations matters more than ever: owners who prioritize structural integrity, water management, and safety systems first are far better positioned than those who chase visible upgrades while ignoring the bones of the house.

How homeowners can rethink their repair priorities

Given the pressures, I find that the most practical approach is to treat home maintenance like a risk management exercise rather than a wish list. That starts with an honest inventory of what is already overdue, from roof inspections and gutter cleaning to HVAC servicing and electrical checks. Studies showing that 71% of owners are behind on maintenance and that 60% are actively putting off necessary work suggest that most households have more lurking issues than they realize, a reality underscored by both the consumer More than 40% warning and the broader Study on delayed maintenance.

From there, the priority list should focus on anything that can cause cascading damage or safety hazards if it fails. That means leaks before landscaping, electrical issues before new lighting, and roof and gutter work before exterior paint. The experience of California owners who regretted ignoring home repairs like Roof and Gutter Neglect and Clogged drainage is a reminder that the least glamorous jobs often protect the most value. In a climate where 44 percent of homeowners admit they have delayed routine maintenance and many are also cutting back on coverage, as highlighted in the survey that begins with Within the, getting that order right can be the difference between a manageable repair bill and a crisis that reshapes a family’s finances.