The small upgrade that can reduce risk ratings in some homes

Home insurers are scrutinizing properties more closely, and small details inside your walls and ceilings now carry real financial weight. One of the most effective ways to shift how your home is scored for risk is not a flashy remodel, but a targeted upgrade that quietly cuts the odds of a claim and signals to underwriters that your place is a safer bet.

By focusing on a modest but strategic improvement, you can lower the chance of fire, water, or storm damage while nudging your risk rating into a more favorable tier. That, in turn, can help you push back against rising premiums and keep coverage available at a time when many households are being forced to make painful tradeoffs just to stay insured.

Why insurers are suddenly obsessed with “small” upgrades

Insurers are moving away from broad assumptions about neighborhoods and toward a more granular view of each property, which means your individual upgrade decisions matter more than they used to. Dec data from Matic’s year‑end data shows that the premium gap between newer roofs and those 11 to 15 years old has widened consistently, a sign that underwriters are pricing specific conditions rather than relying on broad assumptions. When a relatively modest change, such as replacing a worn roof covering or adding a safety device, can move you into a lower risk bucket, it becomes a powerful lever for your budget.

At the same time, you are facing pressure on multiple fronts as climate losses, rebuilding costs, and reinsurance all feed into higher bills. Most homeowners, a full 68%, report they have already made financial sacrifices to afford home insurance, and Nearly 1 in 3 homeowners would let insurers monitor home cameras to save on premiums. Against that backdrop, a targeted physical upgrade that reduces your risk rating can be more attractive than trading away privacy or cutting other essentials from your budget.

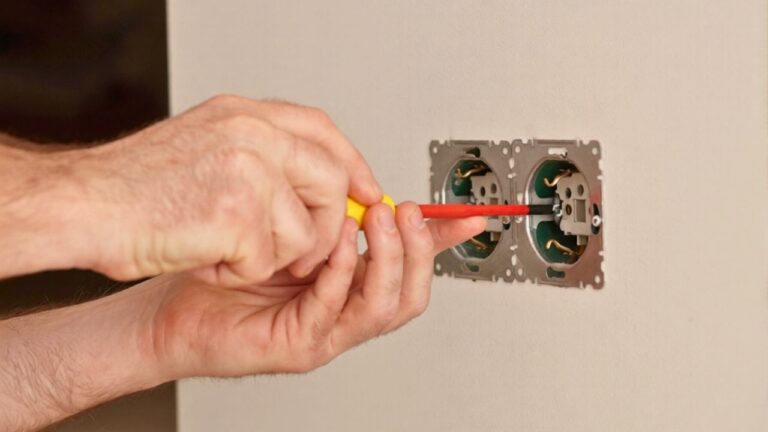

The quiet hero: modernizing your electrical system

If you are looking for a single, relatively contained project that can change how your home is scored, upgrading your electrical system is one of the most effective moves you can make. Older wiring, overloaded panels, and outdated breakers are a leading source of house fires, and insurers know it, which is why they often flag knob‑and‑tube wiring or fuses as red‑flag risks. When you replace aging components with modern wiring, grounded outlets, and arc‑fault or ground‑fault protection, you sharply reduce the chance of a fire starting behind your walls, which is exactly the kind of loss underwriters fear most.

Here, the savings potential is not just theoretical. Guidance for homeowners notes that if You upgrade the electrical panel or completely overhaul your electrical system, you can qualify for lower premiums because you are cutting the odds of a catastrophic fire at the source. One analysis explains that If you upgrade the electrical infrastructure, you are not only bringing your home up to current safety codes, you are also aligning with how insurers now price risk. That combination of safety and financial benefit is why a modern electrical system is often the small upgrade with outsized impact on your risk rating.

How a safer electrical system reshapes your risk profile

From an insurer’s perspective, your home is a bundle of probabilities, and outdated wiring pushes several of those probabilities in the wrong direction. Faulty connections can spark in hidden cavities, overloaded circuits can overheat, and ungrounded outlets can damage electronics, all of which translate into potential claims. When you invest in a modern panel, properly sized circuits, and protective devices, you are not just swapping hardware, you are removing multiple failure points that would otherwise keep your risk rating elevated.

That is why electrical work shows up repeatedly in lists of home improvements that can lower your insurance costs. Nov guidance on home improvements highlights that Homeowners living in states prone to severe weather or wildfires are especially likely to be rewarded for upgrades that reduce the chance of fire damage. When your wiring is less likely to ignite under stress, your home is better able to withstand both everyday usage and extreme conditions, which is exactly the kind of resilience insurers are trying to encourage through pricing.

Bundling safety: detectors, smart tech, and the “safety trifecta”

Electrical work becomes even more powerful when you pair it with a cluster of low‑cost safety devices that catch problems early. The Safety Trifecta, Smoke, Carbon Monoxide, and Smart Det technology, is a shorthand for a layered approach that combines traditional detectors with connected sensors. When you install interconnected smoke alarms, carbon monoxide detectors, and smart devices that can alert your phone or a monitoring service, you dramatically shorten the time between a hazard emerging and your response.

Insurers increasingly see that kind of setup as a marker of a proactive homeowner. Nov reporting on quick upgrades notes that The Safety Trifecta can help you present yourself as a homeowner worthy of premium relief, because it reduces the chance that a small incident will escalate into a major claim. When your upgraded electrical system is feeding circuits that are monitored by smart detectors, you are stacking protections in a way that can shift your risk rating from “concerning” to “controlled” in the eyes of an underwriter.

Water, heat, and wiring: why system upgrades work together

While electrical work may be the single most influential small upgrade, it rarely exists in isolation. Insurers look at your plumbing, heating, and cooling systems as part of the same risk story, because a burst pipe or failed furnace can be just as costly as an electrical fire. Nov guidance on Upgrading HVAC, Upgrades, HVA and plumbing systems stresses that bringing these systems up to modern standards can reduce both the frequency and severity of claims, especially in older homes where wear and tear has accumulated out of sight.

Replacing aging systems before they fail is more effective at reducing claims than waiting for a crisis, which is why experts emphasize that Replacing aging systems before they break is a smart move. When you coordinate an electrical upgrade with targeted improvements to your HVAC and plumbing, you are essentially rewriting the risk narrative of your home from “old systems nearing failure” to “modern infrastructure designed to prevent losses.” That holistic shift is what can move your property into a more favorable tier when your insurer recalculates your risk rating.

Roof and structure: the other small upgrade that punches above its weight

Alongside wiring, your roof is the other component that can dramatically change how your home is scored, even if the work itself feels like a straightforward replacement. New Roof The roof is considered the single biggest factor affecting your policy, because it is your first line of defense against wind, hail, and water intrusion. When you install a new covering with modern fastening systems and impact‑resistant materials, you are not just improving curb appeal, you are cutting the likelihood of leaks and interior damage that can trigger large claims.

Insurers are explicit about how much they care. One analysis explains that New Roof The condition of your roof is central to your premiums, and Dec data from Matic shows that the premium gap between newer roofs and those 11 to 15 years old has widened as underwriters sharpen their pricing. When you combine a new roof with upgraded electrical and safety devices, you are addressing both the envelope that keeps weather out and the systems that prevent fires inside, which together can substantially lower your perceived risk.

Documentation: turning upgrades into actual discounts

Even the smartest upgrade will not help your premiums if your insurer never hears about it, which is why documentation is as important as the work itself. You should keep detailed records of invoices, permits, and inspection reports for your electrical, roofing, and system upgrades, and be ready to share them when your policy renews. By keeping records of this work, you give your insurer concrete evidence that your home is safer than it used to be, which can justify a lower risk rating.

Nov reporting, Posted Monday, notes that Fausto Bucheli highlighted how crucial it is to present proof when you ask for a discount, and that By keeping records of this kind of work, you make it easier for your insurer to adjust your premiums. Some carriers even specify that certain upgrades, such as monitored security systems or leak detection devices, can qualify you for a discount of up to 10%, a figure echoed in coverage that notes a discount of up to 10% for specific safety improvements. Without documentation, those potential savings are easy to leave on the table.

Designing for resilience from the start

If you are building or doing a major renovation, you have an opportunity to bake risk reduction into the design rather than retrofitting later. Small, upfront design choices, such as specifying fire‑resistant materials around electrical panels or adding advanced leak detection near water heaters, can prevent the kinds of losses that drive premiums higher. One industry analysis notes that Small, upfront design changes like fire‑resistant materials or advanced leak detection can lead to immediate and significant reductions in insurance premiums, making homeownership more affordable.

That same logic applies to your electrical layout. If you are opening walls anyway, you can add extra circuits to avoid overloading, install whole‑house surge protection, and route wiring away from areas prone to moisture. When you pair those decisions with structural choices like reinforced roofing and impact‑rated windows, you are creating a home that is engineered to avoid the very events insurers price into their models. Over time, that design‑level resilience can keep your risk rating lower than comparable homes that were built without those considerations.

Making the upgrade pay off in a high‑cost insurance era

With premiums rising faster than many household budgets, you need every lever available to keep coverage sustainable. Invest guidance for homeowners stresses that you should not just accept higher bills, but instead look for specific home enhancements that can significantly reduce your insurance costs. When you focus on targeted projects like electrical modernization, roof replacement, and system upgrades, you are aligning your spending with the factors that underwriters weigh most heavily, rather than scattering money across cosmetic changes that do little for your risk rating.

There is also a strategic timing element. There are clear signals that Invest in improvements: There are specific upgrades, such as modern electrical and plumbing systems, that may result in insurance premium discounts when you notify your carrier. If you plan your projects around renewal dates, you can present a package of improvements just as your insurer is recalculating your rate, giving you the best chance to convert that small upgrade into a lower risk rating and a more manageable bill.

How to prioritize your next move

When you are staring at a long list of potential projects, it helps to rank them by how much they change your risk profile relative to their cost. Electrical modernization, a sound roof, and core system upgrades consistently rise to the top because they directly address the causes of the largest claims. Guidance on home improvements that lower insurance costs suggests you start by asking your agent which specific upgrades your carrier rewards, and notes that you should Ask your insurance agent if certain projects, such as electrical work or earthquake retrofitting, qualify for discounts before you spend the money.

Once you have that information, you can build a simple plan: tackle the upgrade that removes the biggest red flag first, then layer on lower‑cost safety devices that complement it. Over time, that sequence turns your home from a collection of aging parts into a coordinated system designed to prevent losses. In a market where Most homeowners are already cutting back in other areas to afford coverage, using one small but strategic upgrade to shift your risk rating is one of the few levers still firmly in your hands.

Like Fix It Homestead’s content? Be sure to follow us.

Here’s more from us:

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.