Why insurers are paying closer attention to maintenance photos and receipts right now

Insurers are no longer treating maintenance as a side note, and you should not either. As property risks climb and claims grow more expensive, carriers are leaning on photos, videos, and receipts to decide what to charge you, what to cover, and in some cases whether to keep your policy at all. If you own a home, condo, rental property, or even a vehicle, the paper and pixel trail around your upkeep is quickly becoming as important as the policy itself.

The new reality: insurance that watches how you maintain things

You are living through a shift in how protection is priced and delivered, where the condition of your property and the proof that you maintain it are central to the deal. Instead of relying only on broad neighborhood data or replacement cost estimates, carriers are tying coverage decisions to the specific age, wear, and repair history of your roof, plumbing, electrical system, and even your car’s bodywork. In 2025, detailed trends for Home, Renters, Condo Insurance show that each Factor in a property’s condition and documented Description of risk is feeding directly into how policies are structured and priced.

This is happening against a backdrop of Market Uncertainty, where High volatility and Many emerging risks are forcing underwriters to scrutinize applicants more closely to avoid substantial losses. When underwriters dig deeper, they do not just ask more questions, they ask for proof. That is why you are seeing more requests for inspection photos, contractor invoices, and time-stamped receipts, and why ignoring those requests can now put your coverage at risk.

Why carriers suddenly care about your receipts and repair logs

Behind every request for a maintenance photo or invoice is a simple financial logic: Carriers pay for covered, accidental losses, not for long ignored wear and tear. Jul and But are central to the way carriers explain this distinction, because Carriers need to show that they are not a warranty service for deferred maintenance. When your insurer asks you to document a roof repair or a new water heater, it is trying to separate damage caused by a sudden event from problems that built up over years of neglect, which are typically excluded from coverage.

That is why Jul, But, and Carriers are all part of a new pattern in which you are told that keeping your policy means making repairs or updates the company wants addressed. When you complete those tasks, the only way to prove it is through dated photos and receipts that show what was done, where, and by whom. Without that trail, you are asking an adjuster to take your word for it at claim time, and in the current environment that is a losing bet.

From “nice to have” to non‑negotiable: maintenance as a condition of coverage

What used to be friendly advice in a renewal letter is now edging into hard requirement. Jul and Sometimes the are showing up in more correspondence, as carriers tell you that certain repairs are not optional if you want to keep your current limits and terms. You might be asked to replace missing shingles, fix loose railings, or remove dead trees, and the letter will often spell out that failure to comply could lead to nonrenewal or a special endorsement that limits what is paid if a related claim occurs.

In practice, that means your insurer can insist on changes and then require proof that you followed through. If the Jul notice says you must repair a deck or remove a hazard, you will be expected to send photos and invoices that match the items the company wants addressed, or risk an endorsement that restricts claims payment. When Sometimes the request is minor, like adding a handrail, the same rule applies: no proof, no assumption that the work was done.

How inspections, drones, and self‑surveys feed the photo trail

Insurers are also generating their own images of your property, then comparing them with whatever you submit. Traditional inspections still matter, and Why Insurance Companies Require Home Inspections is straightforward: Insurance companies inspect homes to gather accurate information, assess risk, and set appropriate premiums for each Homeowner. Those inspections increasingly include digital photo sets of your roof, siding, and yard, which become a baseline against which future maintenance is judged.

At the same time, carriers are experimenting with aerial tools. Insurers in Texas, for example, are watching homes from above and then notifying owners that their policies may not be renewed. While it is unclear how many properties are under this kind of surveillance, the reporting notes that While some of these aerial assessments can be less accurate than human inspections, they still feed into renewal decisions. In California, Insurance companies are increasingly using aerial images instead of human inspectors, But those images can get misinterpreted or capture the wrong home, which makes your own time‑stamped photos and receipts a critical counterweight if you need to challenge a decision.

When your own photos become your best defense

For you, the most powerful images are often the ones you take yourself, before anything goes wrong. Detailed, date‑stamped shots of your roof, foundation, appliances, and major systems can prove that you maintained your property and that damage from a storm or leak was truly sudden. Guidance on Why Photos Are essential is blunt: Photos serve as tangible evidence of your property’s condition, and without it, disputes can arise that leave only a fraction of the claim reimbursed, with the homeowner covering the remaining costs out of pocket.

Insurers themselves are building photo habits into their workflows. Insurers are implementing new solutions that let customers capture damage and repairs through apps, so the right parts and services can be prepared in advance. On the property side, agents increasingly encourage you to keep a digital folder of maintenance photos and receipts, because that archive can shorten claim investigations and reduce the odds that an adjuster questions whether a repair was ever done.

The fraud problem: why your images are being scanned so closely

There is another reason your photos are getting more scrutiny: digital manipulation is now cheap and widespread. Carriers know that a small but costly share of claims involve altered images, so they are investing in tools that can spot inconsistencies in lighting, pixels, or metadata. That is where Aug, Tool, and Support the Effort come in, as insurers look for ways to automate fraud checks without punishing honest customers.

One example is FRISS Media Check As a Tool to Support the Effort, which lets carriers scan images for signs of tampering without slowing down legitimate claims. For you, that means your maintenance photos and receipts are more likely to be trusted if they are clear, consistent, and backed by third party documentation like contractor invoices. Sloppy or inconsistent images, by contrast, can trigger extra questions or delays, even when you are telling the truth.

Condo boards, commercial owners, and the rise of maintenance scrutiny

If you sit on a condo board or own commercial property, the stakes are even higher. In 2025, Carriers are placing greater scrutiny on a building’s age and maintenance history, and Carriers are now more likely to demand evidence that roofs, facades, and life safety systems have been kept up to code. If you cannot produce inspection reports, contractor receipts, and photo records, you may face steep premium hikes or coverage restrictions that ripple through every unit owner’s budget.

On the commercial side, the pressure is amplified by climate risk. Reporting on Aug notes that Severe Weather Events Are Becoming More Common and that Extreme storms are a major driver of rising commercial property claims, especially where flooding hits basements and ground floors. When you seek coverage or file a claim in that environment, underwriters will want to see proof that you installed flood barriers, upgraded drainage, or moved critical equipment out of harm’s way. Photos and receipts are how you show that you did not just talk about resilience, you paid for it.

When insurers can force changes, cancel, or limit your policy

Many owners are surprised to learn how much leverage their insurer has once a risk is identified. If the If the insurer’s recommendation involves physical changes to your property, such as repairing steps or removing a trampoline from the yard, the company can require confirmation that you have complied. That confirmation usually takes the form of photos and receipts, and if you refuse or delay, the carrier can adjust your terms or decline to renew.

In some states, the rules are explicit. In Massachusetts, insurers can cancel a policy as long as they provide a 45-day written notice and a qualified reason for the decision. That reason might be an aerial image that shows roof damage or debris, or an interior self inspection that reveals outdated wiring. Insurance companies use to do drive by checks, but now they often ask you to complete a home interior self inspection, and More often than not, if there were serious issues you would have received an intent to cancel. In that context, sending clear, accurate photos and receipts is not just compliance, it is self preservation.

Turning documentation into leverage: how good records can lower costs

The upside to all this scrutiny is that strong documentation can work in your favor. When you can show a pattern of preventive work, you are not just avoiding nasty surprises at claim time, you are building a case for better pricing. The importance of compliance documentation cant be overstated, because insurers often recognise well documented preventive maintenance with premium reductions. That recognition only happens if you can produce organized records of inspections, repairs, and upgrades when your policy is quoted or renewed.

Even in a tough market, there are signs that documentation is shaping how costs are shared. Dec reporting notes that Matic said homeowners are taking on more of the financial burden through policy structure changes, with Regional differences and 2026 outlook shaping how that plays out. If you want to push back against higher deductibles or narrower coverage, walking into that conversation with a clean photo history and a stack of receipts gives you far more negotiating power than vague assurances that you “keep up with things.”

Practical steps: building a maintenance file your insurer will respect

To keep pace with this new reality, you need a simple but disciplined system. Start by treating every major repair or upgrade as if you will have to prove it to a skeptical stranger five years from now. Take wide and close up photos before and after the work, capture the contractor’s truck or logo in at least one shot, and save the invoice as a PDF. When your insurer or agent asks for documentation, send a curated set of those images and receipts rather than a chaotic dump, so the story of what you did is easy to follow.

Remember that carriers are already building their own visual record of your property. Sep guidance on Why and Insurance Companies Take Pictures of your House explains that insurers photograph your House to assess its condition and create an unbiased record of the damage when something goes wrong. By providing multiple angles of your own, you can correct errors, fill gaps, and demonstrate that you have addressed issues that might still appear in older aerial or street level images. In a market where Jul reporting notes that Many of today’s innovations focus on enhancing policyholder behavior in high risk or catastrophe prone areas, your maintenance photos and receipts are no longer background paperwork. They are part of the core data that decides how well you are protected when you need it most.

Supporting sources: Home insurers are demanding policyholders make home updates to …, Home insurers are demanding policyholders make … – AOL.com, Insurance Trends 2025: What To Expect For Homeowners and …, Insurance Trends 2025: What To Expect For Homeowners and …, Home Insurers Are Demanding Policyholders Make … – Bankrate, Home Insurers Are Demanding Policyholders Make Home Updates …, Digital Deceit: The Rising Threat of Image Alteration Fraud – FRISS, In Texas, insurers are watching your home from above. It …, 2025 Trends in P&C Insurance: Technology, Competition and …, Can Insurance Companies Force You to Repair Property?, Home insurers are canceling policies based on aerial images …, What To Expect From a Home Insurance Inspection, Why Commercial Property Claims Are Rising in 2025—and How …, Home insurance premium growth cooled in 2025, but costs …, Do You REALLY Need Photos for Insurance Claims?, Why do Insurance Companies Take Pictures of your House — Carol Klein, Why Did Condo Insurance Go Up in 2025? | Understanding Costs, Vehicle Repair Delays: The challenges currently facing the industry, California Insurers Use Drones, Sometimes Incorrectly, to Assess Policies, Home Interior Self-Inspection, Preventive vs Reactive Maintenance: Costs, ROI, Best Practices.

Like Fix It Homestead’s content? Be sure to follow us.

Here’s more from us:

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

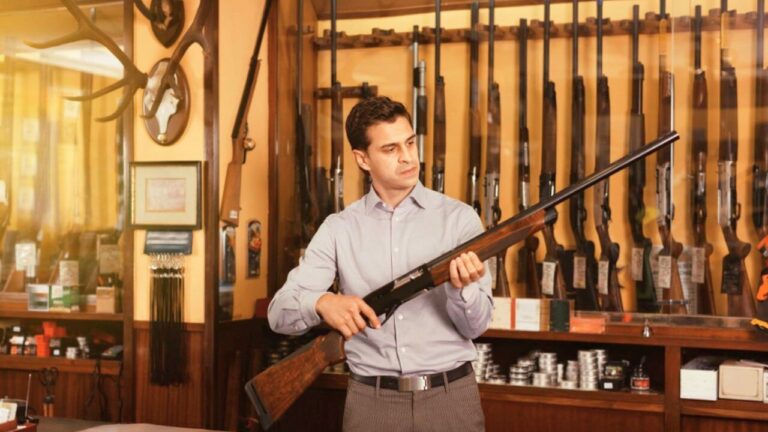

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.