Why small electrical fixes can raise insurance questions later

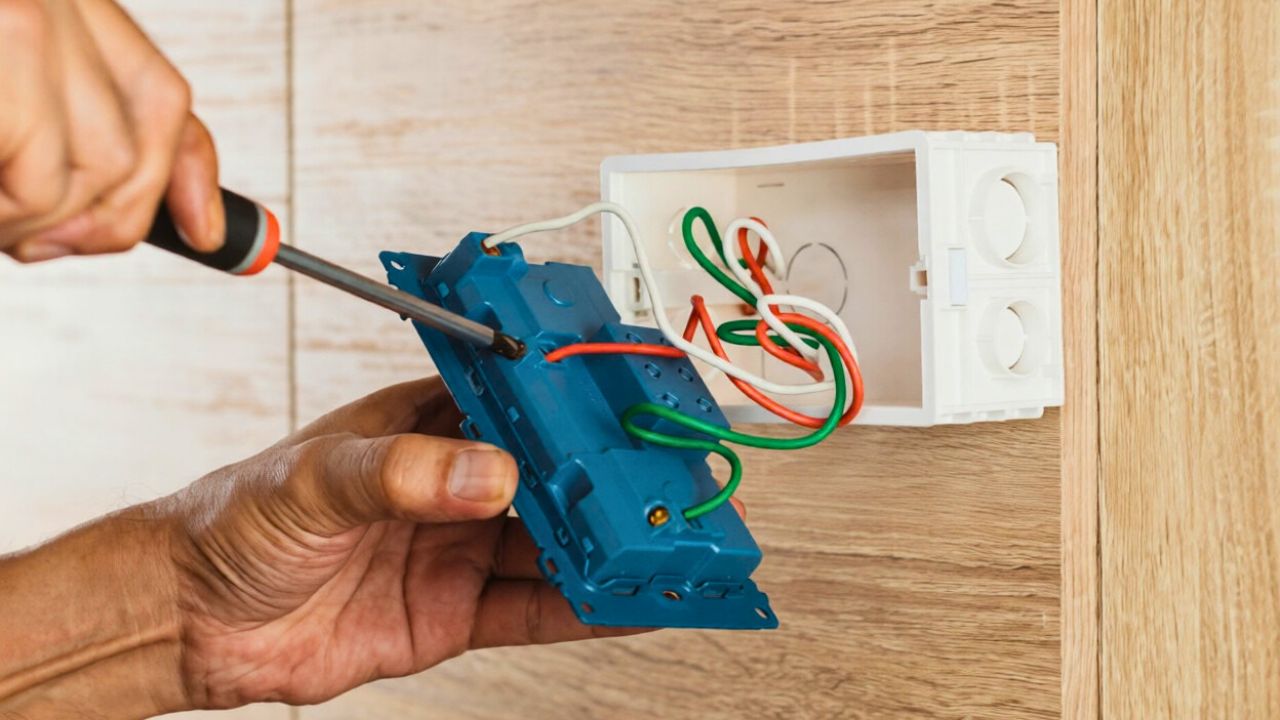

Small electrical jobs in your home can feel too minor to worry about, yet they are exactly the kind of changes that can complicate an insurance claim years later. When you swap a light fixture, replace a breaker, or add an outlet, you are quietly changing the risk profile your insurer thought it was pricing. If something goes wrong and the wiring is not up to standard, the investigation that follows a fire or shock injury can turn a quick fix into a coverage dispute.

Insurers increasingly expect you to treat electrical safety as part of basic home maintenance, not an optional upgrade. That means even modest tweaks can raise questions about who did the work, whether it met code, and whether you disclosed bigger issues that surfaced along the way. Understanding how those details play into underwriting and claims decisions helps you decide when to call a licensed electrician, when to notify your carrier, and when a “simple” repair is anything but.

Why insurers care about “little” electrical jobs

From an insurer’s perspective, your wiring is not a background detail, it is one of the main predictors of fire risk. Electrical faults are a leading cause of house fires, so companies scrutinize anything that might increase the chance of overheating conductors, loose connections, or overloaded circuits. When you change fixtures, add receptacles, or swap a breaker, you are altering a system that is supposed to be designed and maintained to modern safety standards, and that is why even small jobs can draw attention if a claim follows.

Specialists in residential risk point out that owning a home comes with responsibilities that go beyond paying the premium, including keeping electrical systems in safe working order and addressing known hazards before they cause damage. Guidance on how electrical issues stresses that insurers look at the overall condition of your wiring, panels, and devices when deciding whether to write or renew a policy. If a post‑loss inspection reveals that a fire started in an area you recently “fixed” yourself, the adjuster will ask whether that work contributed to the loss and whether it complied with code.

How small fixes can snowball into coverage problems

The risk with minor electrical work is not just that something might be wired incorrectly, it is that a small shortcut can create a chain of failures that only becomes visible after a serious incident. A loose connection behind a new light switch can generate heat for months before igniting nearby materials, and by the time a fire investigator traces the origin, your quick Saturday project becomes a central question in the claim file. If the work did not follow manufacturer instructions or local code, the insurer may argue that you increased the hazard in a way the policy did not contemplate.

Home insurance specialists warn that policies are designed to respond to sudden, accidental damage, not to long‑term deterioration or preventable hazards that were ignored. One overview of electrical problems and notes that carriers often distinguish between damage caused by a covered peril and repairs needed because of outdated or unsafe wiring. If your “small fix” masks a deeper issue, such as undersized conductors or an overloaded panel, the insurer may cover the resulting fire damage but refuse to pay for bringing the entire system up to code, leaving you with a large out‑of‑pocket bill.

DIY pride versus the insurance file

Doing your own electrical work can be tempting when you are staring at an hourly rate for a licensed electrician, but the savings can evaporate if a claim later hinges on whether the job was done properly. Insurers are not automatically hostile to DIY, yet they do expect that any work on critical systems like wiring, plumbing, or roofing meets the same standards a professional would follow. When an adjuster reviews a loss, they will look for permits, inspection records, and invoices that show who touched the system and when.

Risk advisers who work with homeowners emphasize that some projects are simply too risky to treat as a learning experience. One analysis of when DIY can backfire explains that if an unlicensed repair is linked to later damage, your carrier may question coverage or reduce a payout. Electrical contractors echo that warning, noting that Apr guidance on Many homeowners attempt to handle electrical work themselves, but However improper installations increase the risk of electrical fires and system failures. In an era of detailed claim investigations, that is a gamble with your largest asset.

Old panels, new rules, and why upgrades are no longer optional

Even if you never touch a wire, the age and design of your electrical panel can trigger hard questions from your insurer. Older equipment was built for a different era of household demand, and some legacy panels and fuse boxes have documented safety issues that make them unacceptable to modern underwriters. When you add a new circuit for a kitchen appliance or electric vehicle charger, you are forcing that old infrastructure to carry loads it was never meant to handle, which is exactly the scenario insurers want to avoid.

Specialists in electrical safety warn that Outdated electrical panels may fail to meet modern safety standards and can put your home insurance coverage at Risk. Contractors who work with carriers report that companies are increasingly requiring upgrades as a condition of issuing or renewing a policy, citing the increased risk of fire and equipment failure. One overview of why insurance companies are explains that, due to the increased risk associated with older systems, homeowners may be asked to replace panels or wiring before binding or renewing their insurance policy. If you respond to that pressure with piecemeal fixes instead of a full upgrade, you may satisfy no one: the risk remains, and the paper trail shows you knew about it.

When a “repair” looks like a red flag to your insurer

Insurers do not just react to catastrophic failures, they also pay attention to patterns that suggest a home is not being maintained. Repeatedly resetting a tripping breaker, swapping fuses, or replacing scorched outlets without addressing the underlying cause can all look like neglect in a claim file. If a fire eventually starts on that same circuit, the history of quick fixes can be used to argue that you ignored warning signs.

Electrical safety guidance notes that Insurers expect you to maintain your property to a reasonable standard, and Repeated electrical issues that are not properly addressed can be treated as negligence, which could cost you thousands. Farm risk specialists make a similar point, warning that Installation Errors Improper electrical work can create unsafe conditions that lead to short circuits and faults to ground. In both residential and agricultural settings, a pattern of band‑aid repairs instead of root‑cause fixes can influence how a claim is evaluated and whether a renewal comes with higher premiums or new conditions.

How inspections and underwriting catch “small” issues

Electrical work does not exist in a vacuum, it sits inside a broader picture of your home that insurers build through inspections and questionnaires. When you apply for coverage or increase limits, you may be asked about the age of your wiring, the type of panel, and any recent upgrades. If your answers do not match what an inspector or adjuster later sees on site, that discrepancy can become a sticking point in a claim, especially if the loss is tied to an area you recently modified.

Real estate professionals advise that a thorough home inspection can reveal when an entire electrical upgrade is needed, for example if you do not have enough amps of power in your panel or if the wiring does not meet current codes, or the home may be unsafe. One guide to inspection may also that kind of deficiency long before a claim. On the insurance side, consumer advisers explain that when your carrier asks you to make changes, Often that means making repairs or replacements to reduce the likelihood of a claim, and the request may arrive shortly before the policy renews with a list of items the company wants addressed. If you respond with partial or undocumented fixes, you may satisfy the letter of the request but still face questions later.

Storm damage, emergency fixes, and the claim clock

Electrical problems often surface after storms, when downed lines, water intrusion, or power surges damage panels and circuits. In that stressful window, you are trying to make your home safe while also preserving your right to insurance benefits. The tension is that you are generally required to prevent further damage, yet permanent repairs made before an adjuster sees the loss can complicate or even jeopardize your claim.

Property claim specialists explain that Making permanent repairs before an adjuster inspects the damage can result in claim denial, while temporary measures to prevent further harm are expected. Attorneys who handle hurricane disputes add that While you are obligated to prevent further damage through emergency steps like tarping or boarding, making permanent repairs before the insurer documents the loss can result in denied claims or reduced payouts. In video guidance, licensed adjuster Mike Keeler addresses homeowners who ask, “What can I do, how can I do it, what do I need to show the insurance company,” and his advice in What underscores the importance of photos, receipts, and clear separation between temporary safety work and full restoration.

When insurers insist on electrical upgrades

Even if you have never filed a claim, your insurer may still push you to modernize your electrical system as part of its risk management strategy. Carriers are increasingly using inspections, aerial imagery, and data about equipment brands and ages to flag homes that fall outside their comfort zone. If your panel, wiring type, or service size is on that list, you may receive a letter stating that coverage will be non‑renewed unless specific upgrades are completed by a deadline.

Industry briefings describe how, due to the increased risk associated with certain older panels and wiring methods, insurers are requiring homeowners to complete electrical upgrades before issuing or renewing their insurance policy. One detailed explanation of why insurance companies are taking this stance notes that the goal is to reduce fire losses and stabilize premiums. Consumer advisers add that when your carrier sends a list of required changes, That means making repairs or replacements to reduce the likelihood of a claim, and the notice often arrives shortly before renewal, leaving you little time to act. In that context, trying to satisfy the requirement with a patchwork of small fixes instead of a documented upgrade can be a costly miscalculation.

Older wiring, modern expectations, and your next claim

Many homes still rely on wiring systems that predate today’s electrical codes, including knob‑and‑tube or early aluminum branch circuits. You might only interact with that infrastructure when you replace a light or add a receptacle, but each small change can expose the limitations of the original design. If you extend an old circuit to power modern loads, you may be increasing the chance of overheating or loose terminations, which are exactly the conditions that lead to fires and insurance disputes.

Electrical contractors who field coverage questions explain that, for example, if your 50 year old home still has knob‑and‑tube or aluminum wiring, your insurer may limit coverage or require upgrades because of the higher risk associated with these older wiring types. One guide on whether Does Home Owners Insurance Cover Electrical Repairs notes that carriers may pay for damage caused by a covered event but not for replacing obsolete wiring that did not meet current standards. In some markets, panels associated with higher failure rates have become effectively uninsurable, a point underscored in training sessions on replacing electrical panels where experts walk through uninsurable panels required to be changed before coverage is bound. If you keep attaching new fixtures to that legacy system without a comprehensive plan, you are building future friction into every claim.

Practical steps before you touch the next switch

Like Fix It Homestead’s content? Be sure to follow us.

Here’s more from us:

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.