Why temporary fixes can void parts of a home insurance policy

When a pipe bursts or a storm rips shingles off your roof, your first instinct is to stop the damage any way you can. Yet the quick patch you throw on in the chaos can quietly undercut the very home insurance coverage you are counting on. Temporary fixes are not just a practical question of tarps and duct tape, they are a legal and financial tightrope that can affect whether your insurer pays, how much it pays, and even whether parts of your policy still apply.

The fine print in homeowners policies expects you to protect your property, but it also expects you not to alter the damage in ways that make it harder to inspect or more expensive to repair. The line between a reasonable short‑term repair and a coverage‑killing “cheap fix” is thinner than it looks, and understanding where it sits before you start swinging a hammer can save you thousands of dollars.

Why insurers care how you “stop the bleeding”

Most policies give you a duty to prevent further damage after a loss, which is why you are expected to board up broken windows or cover a leaking roof. Regulators explain that you are supposed to make reasonable efforts to protect the home, then document the damage and contact your insurer promptly so an adjuster can see what happened, a point echoed in guidance on storm damage. At the same time, consumer materials on claims handling stress that you should tell your company as soon as possible because most insurers set deadlines for reporting and for submitting proof of loss, which is why you are urged to tell your insurer quickly rather than rebuilding half the room before anyone arrives.

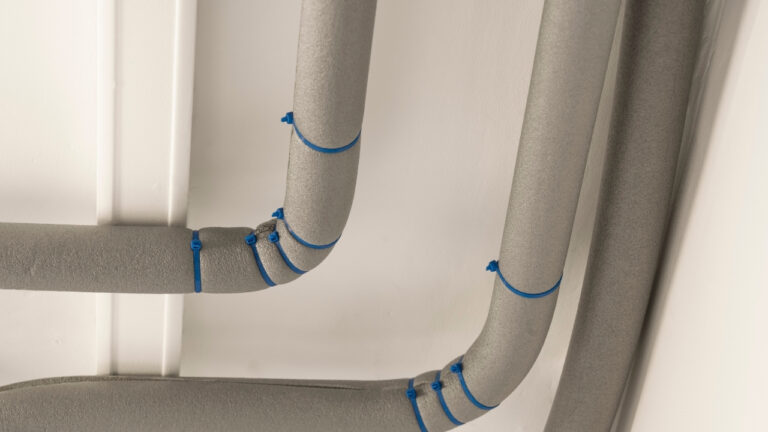

That tension, between your duty to mitigate and the insurer’s need to inspect, is where temporary repairs can start to threaten coverage. Legal commentary on “duties after loss” notes that you are expected to make reasonable repairs to protect the property, but that does not mean permanent work is required right away, and in most cases it specifically means short‑term measures like tarping, boarding, or shutting off water, not full reconstruction, because aggressive rebuilding can even lead to the claim being denied if it obscures the original damage, as explained in a discussion of duties after loss. When you go beyond stabilizing the situation and start replacing materials, you give the insurer room to argue that it cannot verify what was actually harmed by the covered event versus what might be the result of your own work.

When a “temporary” repair crosses the line

Insurers generally accept that some short‑term work is necessary, but they draw a line at fixes that change the structure or hide the extent of the loss. One legal guide defines temporary repairs as short‑term measures made to protect your property from further damage, such as tarping a roof or boarding a door, and emphasizes that these are usually allowed and sometimes required, as long as you keep records and stay within policy limits, a point laid out in an FAQ on temporary repairs. Roofing specialists add that insurers expect you to document the condition before and after any short‑term work, including photos and itemized receipts for all services and supplies purchased, because that paper trail is what lets them reimburse reasonable costs while still verifying the original loss, as outlined in a guide to temporary roof repairs.

The trouble starts when a stopgap becomes a substitute for professional remediation. A legal analysis of homeowner claims warns that DIY repairs might not meet building codes or industry standards and that if you attempt repairs yourself and cause further damage or injury, you might be held financially responsible, with the insurer potentially reducing or denying payment because your work changed the risk profile, as described in a discussion of DIY repairs. Another claims‑focused analysis gives a concrete example: if wind blows shingles off your roof and exposes the felt and sheathing, leaving it open to rain can be considered a failure to mitigate, but trying to permanently re‑shingle the roof yourself before an inspection can also backfire, because the insurer may argue it cannot tell what was storm damage and what was your workmanship, a scenario described in a piece on starting repairs.

The “cheap fix” that shifts blame back to you

From your perspective, jumping in with a quick repair after a storm, leak, or collision feels responsible. Yet coverage disputes often turn on whether that fix changed the story of the loss. Reporting on post‑claim disputes describes how a “cheap fix” can become a coverage problem when an insurer argues that the real cause of the current damage is not the original event but your later decisions, a shift in blame that lets the company point to your choices as the root cause rather than the peril you reported, a pattern highlighted in an analysis of cheap fixes. If you patch a ceiling with the wrong materials and mold later spreads behind your work, the insurer can argue that the mold stems from your inadequate repair, not the original leak, and that part of the claim may fall outside what the policy was meant to cover.

Contractor mistakes can create a similar problem. Guidance on property damage caused by contractors explains that while homeowners insurance typically does not cover poor workmanship itself, it may cover resulting damage that is caused because of that poor work, as long as the resulting damage is not excluded somewhere in your policy, a distinction spelled out in a discussion of resulting damage. If your handyman’s “temporary” structural brace fails and cracks a load‑bearing wall, the insurer can try to separate what is attributable to the original covered event from what stems from the contractor’s error, potentially leaving you to chase the contractor’s liability coverage or pay out of pocket for part of the loss.

Documentation, deadlines, and DIY traps

Even when your temporary repair is reasonable, poor documentation can make it look like you altered the loss in ways that justify a lower payout. Roofing claim guidance stresses that you should photograph the damage before any work, then again after you install tarps or boards, and keep invoices and receipts for every material and service, because if your loss is covered, reasonable costs for temporary repairs are typically reimbursable as long as you can prove what you spent, a practice reinforced in instructions on temporary repairs. Another roofing‑focused FAQ notes that most homeowners insurance policies explicitly state that temporary repairs are covered when they prevent more damage, but they also cap how much you can spend and expect you to ask how much you can spend on temporary repairs before you exceed what the insurer will reimburse, a limit described in a guide on temporary repair coverage.

DIY work adds another layer of risk. A consumer explainer on filing claims for self‑performed work notes that if you are handy and decide to repair some damage yourself, you still need to contact your insurer early, because companies often have specific rules about when you can start and what proof they will accept, advice echoed in guidance on how to file DIY repair. Legal commentary on homeowner repairs warns that one of the biggest risks of making repairs before contacting your insurance company is that you might cause delays in the claims process, and that policy terms and conditions can allow an insurer to deny or limit coverage if your actions conflict with those requirements, a point made in an analysis of policy terms. The safest move is to notify the carrier, ask what temporary steps are acceptable, and get that guidance in writing when possible.

How to protect both your house and your policy

Like Fix It Homestead’s content? Be sure to follow us.

Here’s more from us:

- I made Joanna Gaines’s Friendsgiving casserole and here is what I would keep

- Pump Shotguns That Jam the Moment You Actually Need Them

- The First 5 Things Guests Notice About Your Living Room at Christmas

- What Caliber Works Best for Groundhogs, Armadillos, and Other Digging Pests?

- Rifles worth keeping by the back door on any rural property

*This article was developed with AI-powered tools and has been carefully reviewed by our editors.